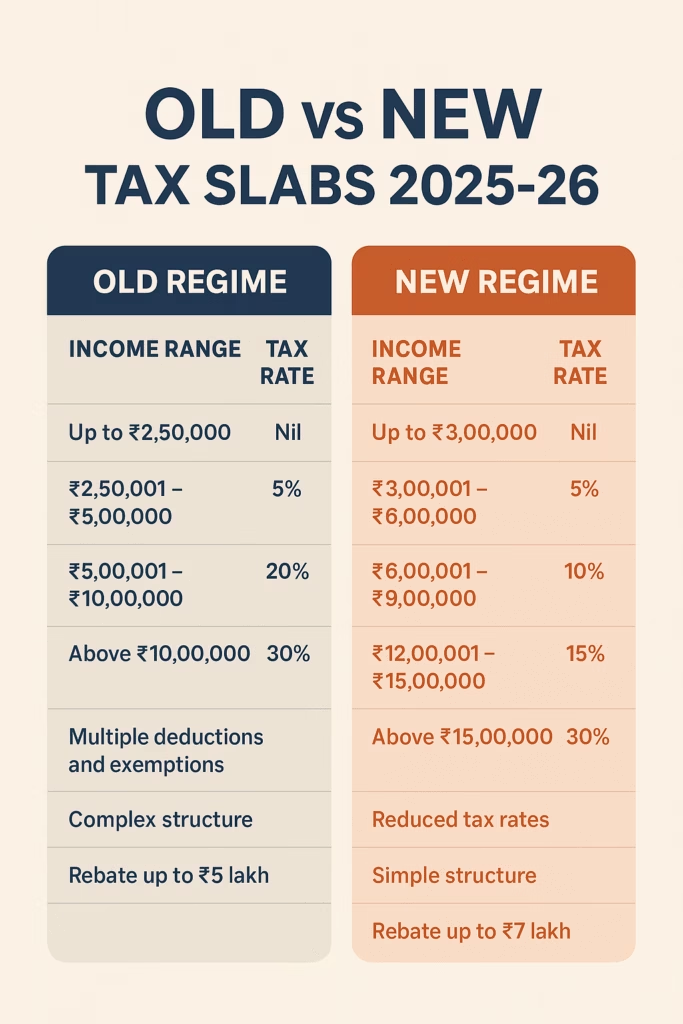

“Compare Old vs New Income Tax Regime A.Y. 2025-26 at a glance.”

The Income Tax Slab 2025-26 in India is one of the most discussed topics for salaried employees, professionals, and business owners. Every year, the government reviews tax slabs in the Union Budget. These slabs decide how much tax you pay based on your income. In this article, we will explain the latest tax slabs, compare the Old and New Tax Regimes, and help you choose the right option for the financial year 2025-26.

What is an Income Tax Slab?

India follows a progressive tax system. This means the tax rate increases as your income increases. For example, people with lower income pay a lower percentage of tax, while those in higher income brackets pay more. These ranges are called income tax slabs.

Income Tax Slab 2025-26 (New Regime)

Under the New Tax Regime, the government offers reduced tax rates but removes most exemptions and deductions.

Here are the proposed income tax slabs for FY 2025-26 (AY 2026-27):

| Income Range | Tax Rate |

|---|---|

| Up to ₹3,00,000 | Nil |

| ₹3,00,001 – ₹6,00,000 | 5% |

| ₹6,00,001 – ₹9,00,000 | 10% |

| ₹9,00,001 – ₹12,00,000 | 15% |

| ₹12,00,001 – ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

👉 Note: A rebate under Section 87A is available if your taxable income is up to ₹7 lakh in the New Regime.

Income Tax Slab 2025-26 (Old Regime)

The Old Regime continues to provide multiple deductions and exemptions, such as HRA, LTA, 80C (PPF, ELSS, LIC), 80D (Health Insurance), and more.

Here are the Old Regime slabs for FY 2025-26:

| Income Range | Tax Rate |

|---|---|

| Up to ₹2,50,000 | Nil |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

👉 A rebate under Section 87A is also available for taxable income up to ₹5 lakh in this regime.

Old Regime vs New Regime – Which is Better?

Choosing between the Old and New Regime depends on your income structure and investment habits.

- New Regime: Better for those who do not claim many deductions. It has simpler, lower tax rates.

- Old Regime: Suitable if you claim deductions under 80C, 80D, HRA, LTA, and others.

Example:

If you earn ₹12 lakh annually and invest ₹1.5 lakh in PPF, ₹50,000 in NPS, and pay ₹25,000 health insurance, the Old Regime may save you more tax. However, if you don’t use these deductions, the New Regime could be cheaper.

Key Benefits of New Tax Regime 2025-26

- Higher basic exemption limit (₹3 lakh vs ₹2.5 lakh in Old Regime).

- Lower tax rates for middle-income earners.

- Simplified structure without complex exemptions.

- Rebate up to ₹7 lakh, ensuring zero tax liability for many taxpayers.

Important Things to Remember

- Senior Citizens (60–80 years) and Super Senior Citizens (80+) get higher exemption in the Old Regime.

- You can switch regimes each year if you are salaried. For business owners, switching has restrictions.

- Always calculate tax in both regimes before filing your return.

Useful Resources

- To check official tax updates, visit the Income Tax Department of India.

- For more detailed tax planning, you can explore our guides on:

Infographic Suggestio

Caption: “Compare Old vs New Income Tax Regime 2025-26 at a glance.”

Conclusion

The Income Tax Slab 2025-26 gives you flexibility to choose between the Old and New Regime. The right choice depends on your savings, investments, and lifestyle. Therefore, analyze both options before filing your return.

👉 Call to Action:

Want to save maximum tax this year? Stay updated with the latest tax-saving tips on TaxPeCharcha and share this article with your friends and colleagues.

This is a masterpiece of clarity.